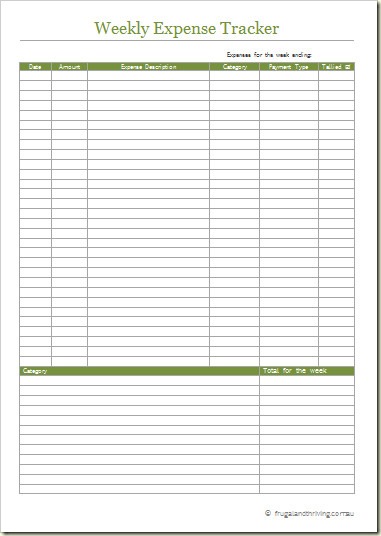

Plenty of people stick to a paper budget as their money tracker method. Pencil and Paperĭon’t dismiss old school methods. Times ten! So, let’s look at different methods to make that happen. You’ll run the risk of continually setting unrealistic budgets, and you’ll never meet your money goals.Īnd that isn’t what we want for you. But if you aren’t tracking your expenses, you don’t know where your money is really going. It’s good to have an impression of what money should go where. Because, let’s be honest, if all you’re doing at the start of each month is jotting down planned budget lines, you aren’t holding yourself accountable to keep within those lines. We just touched on this, but now we’re going deeper. You just drag and drop them to the right budget line. You can connect your budget to your bank, so transactions automatically stream in.

Blank expense tracker printable upgrade#

Quick Callout: If you upgrade to the premium version of EveryDollar, tracking is a breeze. I wanted to sign us up for a couples hip-hop dance class.” That way, neither one of you will ever say, “I didn’t know you spent most of the entertainment budget on ziplining tickets. This is great for accountability and communication.

If you’re married, make sure both of you are working from the same budget and tracking expenses. (How else do you explain the things that go in but never come out?) Whatever works for you and gets every expense tracked with no paper receipts getting lost in that kitchen drawer that must be some kind of portal to another world. That might be once a week or at the end of each day-or it might be before you leave the grocery store parking lot. This is where the magic happens-because this is where you’re keeping up with spending to keep from overspending! Step Four: Set a Regular Rhythm for Tracking Then you can see how much you have left in your different budget categories. If money’s coming out of your wallet, bank account, PayPal, cash envelope, coin purse or old-fashioned piggy bank-track it.Īs you’re tracking, make sure you’re subtracting too. When you buy tickets to see your fave boy band’s reunion tour, subtract that expense from entertainment. When you pay the rent, subtract that expense from your housing line. When you fill up the gas tank, subtract that expense from your transportation budget line. For two, it’s another way to get you in your budget (which is always a solid win). You can add money to your current budget lines or cover some extras in the budget.Įven with a regular income, track it! For one, you can make sure nothing’s off with your paycheck. So, if your income turns out to be more than you planned, now’s the time to adjust. Remember, you planned low when you listed your income. This step is super important if you have an irregular income. If you make money through a side hustle or sell something, log that in too! When your regular paycheck comes in, put it in the income part of your budget. That’s where the tracking comes in! Step Two: If You Make Money, Track It Now that you’ve set up your budget, you’ve got to keep up with it. This is called zero-based budgeting, and, as we said before, it’s all about giving every single dollar you make a job to do. If you’ve got a negative number, lower your planned totals or cut extras until you get zero. If you’ve got money left over, that’s awesome! Put it toward your current Baby Step (the proven, guided path to saving, paying off debt, and building wealth).

It’s a guide you set up to make sure your money does what you tell it to do. Has anyone ever told you a budget is too limiting? The truth is, a budget doesn’t control you-you control it.

0 kommentar(er)

0 kommentar(er)